Cashless Society // Unified Payment Ecosystem

European institutions have been discussing for many years how to create a single and efficient European market, open, free, with fair competition, and consumer protection. There are two regulatory interventions that are significant to the payments industry and which we are going to discuss about: the MIF Regulation and PSD2.

1. MIF Regulation

1. Objectives:

MIF stands for “Multi-Interchange Fee” and has as objective to create an uniform Pan-European Interchange Fee only for general purpose consumer cards (the other cards been excluded). The MIF Regulation was passed in August 2015 and came into effect in December 2015. Unlike PSD2, it contains several specific provisions that are directly applicable to member states, which means it does not need to be transposed into national regulations.

2. Measures:

- Caps on interchange fees will present the largest impact. Acquirers and PSPs are benefiting from the lower rates, but will face technical and operational challenges due to new requirements trading transparency and customer choice at the POS. On the other hand, issuers will lose significant revenue. Three-party schemes are basically not affected, but might need to consider expansion to four-party models. Merchants will benefit from the lower rates although the trickle down for smaller merchants may take some time.

- Acquirer pricing transparency consist of showing the merchant all three pricing components: interchange fees, scheme fees, and the acquirer’s margin. This pricing may be bundled only if the merchant requests in writing.

- Separation of card schemes and processing means that card schemes and their processing entities will have independent accounting, organization, and decision-making processes, Therefore, scheme and processing pricing may not be bundled, cross-subsidized, discriminate between shareholders and other parties, nor make one service conditional on the use of another service or partner.

- Supporting rules are raising the level of competitiveness in the market, and they are four of them. One rule is making issuing and acquiring possible (and necessary) for cross-border within the EU. The other one is that card schemes must allow “co-badging” of two different schemes on a single card. The third one is allowing merchants to require and choose which cards to accept from the cardholder in order to be able to opt for the lowest card fee.

3. Impact on stakeholders due to caps on interchange fees:

-

Impact on card issuers:

The 0.3% cap on credit and 0.2% cap (or $0.05 per transaction, whichever is lower) on debit card interchange fees means reduced revenues for card issuers. Countries accustomed to high credit and debit card interchange fees will feel the most pain. Overall, EU issuers are expected to lose between $5-6 billion annually in interchange revenues. In response to this, issuers are reducing reward levels, increasing cardholder fees, simplifying product sets, reducing expenses, and considering new opportunities that regulation brings, such as lower scheme fees through co-badging. Somme issuers will need to create new business models such as credit and commercializing of data.

-

Impact on three-party schemes:

Three-party schemes, such as Amex and Diners will mostly be unaffected because they do not work with separate issuers and acquirers like other card schemes. However, many American Express GNS (Global Network Services) cards who operate like a four-party scheme (as they are formed through partnership agreements between third parties and the issuer) will be subject to the interchange caps, with no benefit of the higher merchant acceptance rule.

-

Impact on acquirers and PSPs:

Acquirers and PSPs benefit from the margin expansion created by the lower interchange rates because there is no obligation for these reductions to be passed on to merchants. Even though, we can expect that big merchants to start negotiations for better deals, while most small businesses will not in the near-term. Looking at countries in which similar regulations have been implemented (i.e. US, Australia, Spain), we can see that acquirers and PSPs can take on the opportunity and develop pricing and communication strategies to retain existing merchants while enjoying higher margins. Competitors will use lower pricing to attack this strategy.

-

Impact on merchants:

Merchants will benefit of lower fees reflected in bundled rates, but such a shift will take months or even years. Looking at the UK, PSPs that offer bundled rates shows that one month after the regulation came into force there was no material effect on prices for SMEs.

-

Impact on consumers:

Consumers should be the winners of this regulation, but the reality is different. Merchants’ reduced acceptance costs should theoretically result in reduced consumer prices, but the truth is that it will be offset by higher card fees and fewer rewards.

2. PSD 2 (Payment Service Directive 2)

“From January 2018, banks will be forced to open their data vaults through mandated Application Programming Interfaces (APIs). As a result, third parties will be able access (anonymised) customer data to provide new products and services. The goal, beyond compliance, is to break the banks’ monopoly on data and open the market to new innovations,” – says Bragi Fjalldal, CMO and VP Business Development, Meniga.

1. Objectives:

- Contribute to a further integrated and efficient European payments market

- Level the playing field for payment service providers (including new players)

- Ensure a high level of consumer protection and payments security

- Encourage lower prices for payments

- Facilitate the emergence of common technical standards and interoperability

2. Measures:

-

Expanded provisions for consumer protection.

Payment institutions will have to provide more information to consumers, particularly related to payment service fees. In addition, it is introduced the unconditional chargeback right for direct debits, with chargeback conditions harmonized across markets. Generally, these requirements favor larger PSPs because the cost of these changes will weigh heavily on smaller players.

-

Strengthened requirements around payment security customer authorization.

Even though the market wants seamless payments, there is also a need for increased security measures – such as a two-factor authentication – which makes it more difficult to achieve. This measure applies to all online payments, with certain exceptions (i.e. wallets and pre-authorized merchants).

-

“Access to the account” (XS2A).

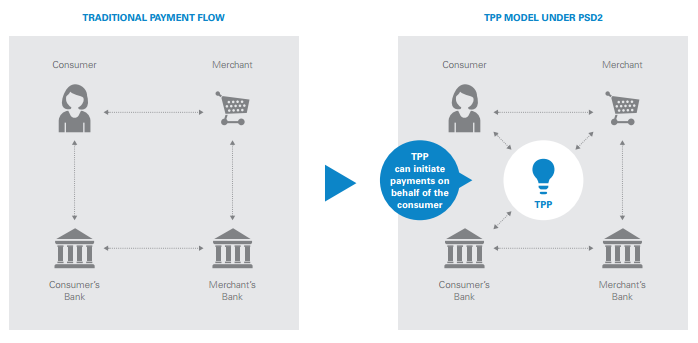

This is definitely the most significant change as part of the PSD2 as it focuses on the formalization of arrangements between banks (who are referred to as “account servicing PSPs” in the regulation) and third parties. Third parties will be able to initiate payments and have access to account information queries with the consumer’s permissions.

Two new roles have been created for this system to work properly: the “Payment Initiation Services” which enable consumers to pay online directly from their bank account (with real-time notifications for merchants); and the “Account Information Services” which provide access to certain current account information such as balance, recent transactions, and account holder name. With access to this information, third parties will be able to aggregate information from several accounts into one online dashboard through an API.

3. Impact on stakeholders due to “access to account” (XS2A)

-

Impact on banks:

Banks will experience greater competition from third-party providers (TPPs) and other innovators. Even though, they have the advantage of an established brand reputation, trusted front-end applications and secure authentication methods. Bank accounts will become better enabled for payments, even if this is done through a TPP, but at the same time it will increase management risks and operations burdens.

-

Impact on pre-authorized merchants:

The pre-authorization of certain trusted merchants is another way to combine security and flawless checkout under PSD2. Together with the provision on access to the account, this solution offers opportunities for larger merchants with returning customers to use card vaults to improve the checkout experience. It also offers opportunities to create payment methods that work at only one merchant or payment modules integrated into merchant apps.

-

Impact on PSPs and acquirers:

PSPs and acquirers could take the opportunity to sidestep strong authentication for merchants, in order to provide a smooth checkout for their clients. The challenge for acquirers and PSPs is to make card vaults and related services available for more merchant categories. Having merchant’s data would contribute to improving fraud analysis and enables merchants outside the top tiers to make more effective anti-fraud decisions. Innovation in improving customer experiences by simplifying the increasingly complex payment ecosystem could provide a new source of revenue for PSPs and acquirers.

-

Impact on Payment Initiation Service Providers (PISPs):

Payment initiation services will have the most impact in retail payments, making it relatively easy to offer services connecting consumers and merchants. Even though, merchants will only begin accepting new payment methods if they present real value over existing payment methods, as much as demonstrating their services are trustworthy. PISPs should take advantage of bank’s established brand image and work together to generate new revenue streams.

-

Impact on large merchants:

Large merchants, especially those operating within in-app environments, will benefit from having the option to directly initiate bank payments. This will allow merchants to receive payments in real-time, directly from a consumer’s bank account – while circumventing card fees and tailoring the checkout experience. Network providers – usually PSPs – will help merchants establishing such connectivity and services.

-

Impact on large tech players:

As the industry wants to make the payment experience as enjoyable and effortless as possible for the consumers, large tech players, such as Google or Apple, could be in the position of a PISP. They have the brand recognition and trust needed to persuade consumers to use their payment methods, and on top of that, they benefit from the strong authentication methods already existent in handheld devices. Apple Pay currently relies on cards schemes’ infrastructure, but is foreseeable that the current account will be added as a funding methods because of PSD2, especially for online use cases.

-

Impact on Account Information Service Providers (AISPs):

AISPs – the second form of access to the account that PSD2 enables – will use valuable identification data from banks to develop new account information services. Two such examples are bank aggregation services and information verification services.

-

Impact on financial management apps:

Having access to information from various bank accounts will create a new role which we refer to as “bank information aggregator”. One potential outcome is combining mobile banking with money management dashboards in one app that shares the same look and feel, combining multiple accounts, from multiple banks. It will provide a user-friendly service for real-time money management, spending advice, access to mortgages, specialized lending products or even investment services.

3. Future Predictions Of The Next Game-Changing Regulations

The next likely area for regulatory revision would be scheme fees. The European Commission has already planned an assessment to determine whether the policy objectives stated in the directive’s preface are being met. In addition, due to technological advancements and recent media coverage, regulators’ attention was drawn in areas such as privacy protection and data access and ownership.

We expect several interventions in these areas as well which will potentially impact PSPs in a number of ways. Firstly, public authorities could demand access to certain pieces of data in the interest of state security or for criminal investigations. Secondly, many PSPs and other technology players see data monetization as a promising future source of revenue. Although there is not yet a business model around reuse of data, industry experts expect innovation to change that.

At the same time, the European Commission may strengthen rules regarding data protection and privacy. Last but not least, even though there is no concrete regulatory initiative in this aspect, it is safe to say that detailed data architecture will only increase in importance.

4. Strategic Advice For Acquires To Keep Up With PSD2 Changes

-

Card acceptance expansion

Acquirers that focus mostly on domestic markets may expect increased competition because of the tendency of centralized acquiring. Even though, they should look into untapped opportunities that the market can offer in terms of acceptance gaps. For example, to look into how consumers and businesses make payments to government entities and where there could appear opportunities for card payments.

Similarly, acquirers may find that insurance premium payments are suitable for card acceptance. A potential important enabler to expand acceptance will be mobile technology which may offer access to untapped markets such as insurance company agency sales. Moreover, mobiles POS acceptance can enable payments closer to an underlying event – take as example the purchase of travel-related insurance by the departing traveler at the airport.

More broadly, opportunities can be found among small and micro businesses – taxis, doctors, street vendors, small office/home office [SOHO] business operators. The best way to communicate with small and micro businesses is through a banking channel as customers know and trust their bank. The sale of low-cost devices through the retail banking channel could add value to account offerings and would help sustain the revenue stream on the retail banking side. Alternatively, if there is insufficient domestic growth, the acquirer may consider to follow their merchants across borders, or central acquiring opportunities.

-

Value-added services for merchants

Acquirers could look to improve their relationship with their merchant customers by providing superior, localized service – such as faster response to technical issues with POS terminals – and through the addition of value added services to strengthen merchant retention and generate new and ongoing fee-based revenue.

-

Potential impact of third-party providers (TPPs) on the acquirer’s business

The TPPs – the new PSD2 category of payment service providers – will have “right of access” to bank accounts with the customer’s permission, in order to check availability of funds and/or initiate a credit transfer or direct debt from current account, as well as to provide services based on account information.

Some believe that the greatest threat that TPPs present to acquirers is in handling eCommerce payments on behalf of merchants, but their success will partially depend on consumer willingness to grant access to their current accounts, along with acceptance of bank transfer fees. Acquirers can “fight back” by deepening their relationship with their merchants – for example, by improving service and offering value-added services to merchants as a means of competitive differentiation.

Moreover, if merchants will embrace technologies such as MPOS, acquirers can help bring an “eCommerce-like” shopping experience to brick & mortar stores – improving shopping experience for customers and potentially bringing more sales to merchants. Also, facilitating e-wallet payments will contribute in the development of mobile payments and maintenance of transaction volumes. Increasingly, more and more acquirers will need to provide such type of services and technologies, no matter if they hold a domestic or international focus.

5. Recommendations Of Value-Added Services To The Merchant From Acquirers

- Cashback – Service to withdraw cash at the POS while making a payment for goods/service

- Mobile Top-up – Service to allow customers to top-up their mobile phone account at the POS using their card

- Prepaid Top-up – Service allowing customers to top-up their prepaid card account at the POS using their card

- Installment – Service allowing customers to choose at the POS, to pay for a purchase in installments

- Contactless – Quick and easy payment for goods / services

- MPOS Solutions – POS devices working together with a smartphone or tablet device through Bluetooth or wireless connections

- Direct Marketing – Electronic customer retention solutions for terminal through customer loyalty discounts, gift card, prepay, and voucher redemption applications

- Connectivity / Broadband – Offer of quick and secure connectivity services bundled with acquiring terminals and solutions

- PCI DSS – Offer of POS PCI DSS certification for merchants or other providers accepting electronic payments

References: